Immersive Insurance Simulation: Experiencing Risks Before They Happen

Photo: © Ulrich Buckenlei | Virtual simulation of insurance scenarios in real-time.

How Virtual Reality is Revolutionizing Risk Management

Insurance is often abstract – but what if customers could experience the impact of risks firsthand? Using cutting-edge VR, AR, and Mixed Reality technologies, damage scenarios can be realistically simulated, making insurance solutions more tangible.

- Experiential Risk Analysis: Customers experience potential dangers up close.

- Real-Time Interaction: Objects and environments can be realistically manipulated.

- Dynamic Control: Insurance advisors can adjust simulations live.

Virtual Earthquake Experience

Photo: © Ulrich Buckenlei | Realistic earthquake simulation for insurance assessment.

Earthquake Scenario: When the Ground Shakes Beneath You

The simulation begins in a calm residential environment. Suddenly, the ground starts shaking, furniture topples over, cracks form in the walls. Within seconds, an ordinary day turns into a catastrophe. But with a simple touch on the insurance advisor’s tablet, everything is restored – impressively demonstrating the value of the right insurance.

- Unpredictable Events: Customers witness how quickly risks become real.

- Digital Damage Analysis: Comparison between protection with and without insurance.

- Emotional Impact: Increased awareness of insurance solutions.

When the Kitchen Catches Fire

Photo: © Ulrich Buckenlei | Fire damage simulation with interactive elements.

Kitchen Fire: The Sudden Blaze

The experience continues in the kitchen. Users can open drawers, pick up objects, and look around. Suddenly, a gas leak explodes, flames spread, and the room fills with smoke. Again, the advisor can reset the scene with a tap, highlighting the importance of insurance coverage.

- Realistic Simulation: Users can manipulate objects in real-time.

- Live Control: Advisors demonstrate risks and solutions in a targeted manner.

- Maximum Immersion: Combination of visual, auditory, and haptic effects.

Experiencing Water Damage in Real-Time

Photo: © Ulrich Buckenlei | Simulation of sudden water damage and its consequences.

Water Damage: The Sudden Pipe Burst

In the bathroom, everything seems under control – until a water pipe bursts. Within seconds, the room is flooded, and water streams from the ceiling. This experience clearly illustrates the value of proper insurance.

- Comprehensible Risks: Realistic depictions of water damage.

- Interactive Learning: Users can manipulate water valves in real-time.

- Simulation for Damage Prevention: Recognizing risks due to inadequate coverage.

Expanded Applications of the Technology

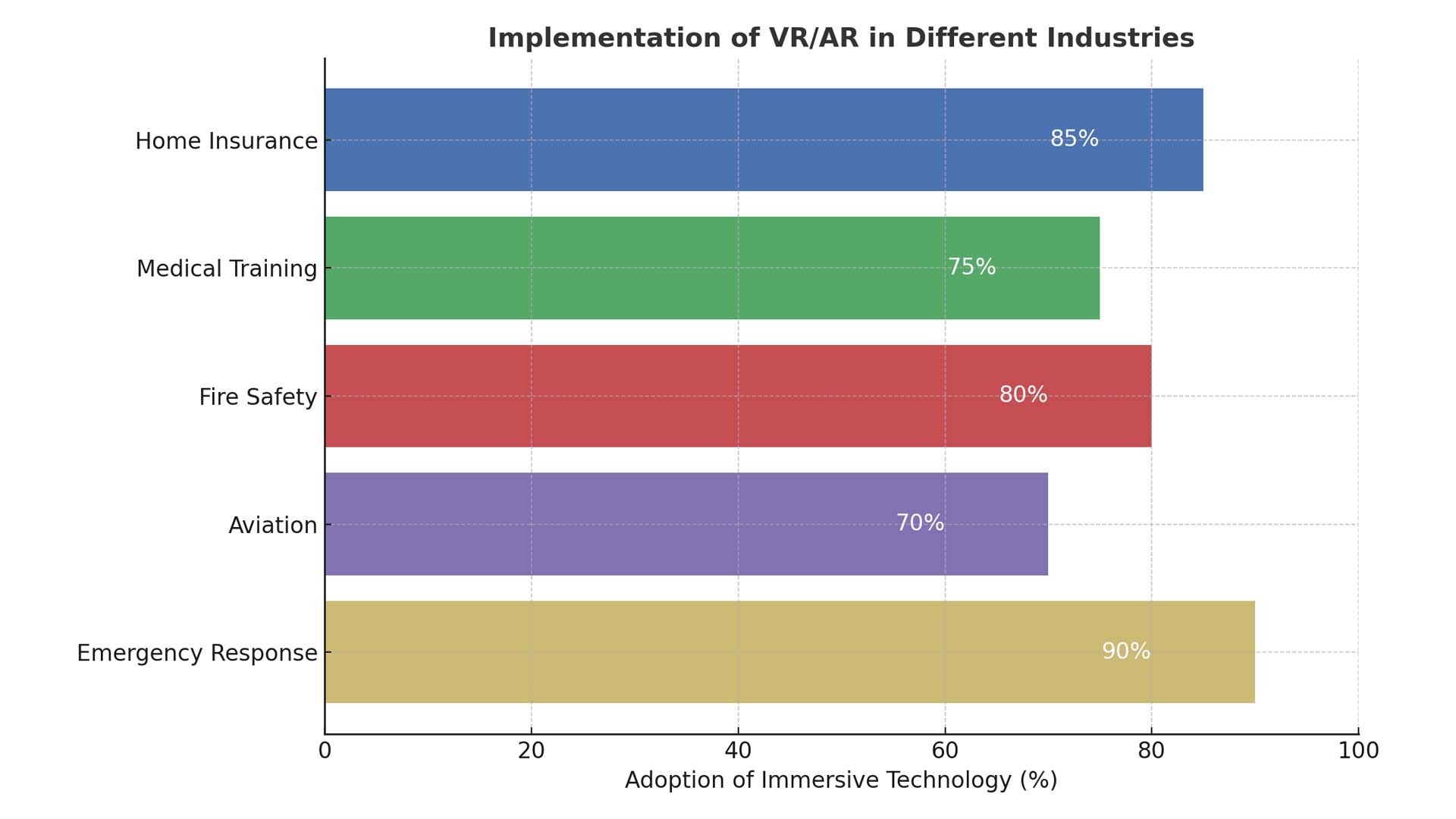

Diagram: Possible applications for immersive simulations.

Expansion Opportunities: Immersive Training for All Industries

The same technology can be applied far beyond insurance – for medical training, firefighter drills, or aviation simulations.

- Medical: Virtual real-time surgical training.

- Firefighting: Training for high-risk scenarios in a safe environment.

- Aviation: Realistic simulation of extreme flight conditions.

Video: Immersive Simulations in Action

Insights into the possibilities of VR-supported simulations for insurance and beyond.

How immersive VR and AR scenarios are successfully used in the insurance industry.

Video: Immersive VR and AR scenarios for insurance.

Invitation to Collaborate

The Munich Visoric Expert Team for Immersive Insurance Simulation is revolutionizing how risks are assessed, understood, and communicated. By leveraging cutting-edge XR technology, AI-driven analytics, and highly realistic 3D scenarios, we provide insurers, customers, and trainees with an interactive, emotional, and practical experience.

- Consulting: Development of tailored XR solutions for insurance training and customer demonstrations.

- Technology Integration: Implementation of virtual and mixed-reality simulations for realistic damage scenarios.

- Data Analysis: AI-powered risk assessment and digital damage modeling for insurers.

Harness the power of immersive simulations to transform your insurance processes.

Contact our Munich Visoric Expert Team today and shape the future of insurance technology with us!

Contact Persons:

Ulrich Buckenlei (Creative Director)

Mobile: +49 152 53532871

Email: ulrich.buckenlei@visoric.com

Nataliya Daniltseva (Project Manager)

Mobile: +49 176 72805705

Email: nataliya.daniltseva@visoric.com

Address:

VISORIC GmbH

Bayerstraße 13

D-80335 Munich